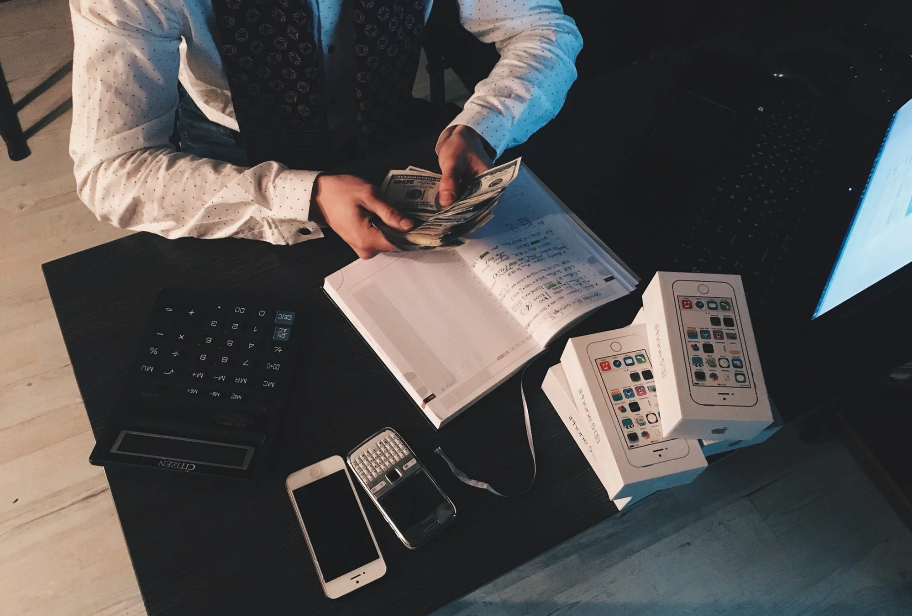

Business Bank Account: Is This A Must For The Self-Employed?

Business account yes or no? Do the self-employed have to have a business current account – or can they also have their business income and business expenses through their private account?

Self-employed = business account mandatory? What does the tax office say?

In principle, there is no legal requirement that self-employed persons must have their own business account. Even the tax office does not require self-employed persons to open a business account. The tax office does not object to business postings that are made via a private account.

For whom is a Business Bank Account mandatory?

The legal obligation to open and maintain a business account applies only to corporations. These include, for example, GmbH, UG, AG, eG, KGaA or eV. These company forms are considered by law to be legal entities with independent legal capacity and legal responsibility. The legal capacity of a corporation is implemented by means of a separate business account. Corporations cannot post their commercially based financial transactions via a private account.

Is a Business Account mandatory for small Businesses?

Small entrepreneurs have the same legal status as self-employed and freelancers. While small entrepreneurs are exempt from the obligation to charge VAT, self-employed and freelancers are generally subject to VAT. The exemption from the obligation to pay VAT, which leads to the status of small entrepreneur, has no influence on any obligation to maintain a business account.

Is the Business Account compulsory for Freelancers?

Freelancers can also decide for themselves whether they wish to keep a business account for the monetary transactions of their commercial income and expenditure. They can also post their business payment transactions via their private account.

What do the Banks say? Is the Business Account compulsory for Self-Employed Persons?

Many banks stipulate in their General Terms and Conditions that their customers may not conduct their business payment transactions via their private current account. It is therefore worth taking a look at the General Terms and Conditions of the bank where the self-employed person has his or her account. But even if there is no reference to a delimitation in the bank’s general terms and conditions, there are reasons for the financial institution to object to the commercial use of the private account. This is because for a commercial operation, the number of monthly bookings increases and with it the cost of managing the account. In addition, in the German Civil Code, the legislator prescribes different rules for banks for their dealings with business customers than with private customers.

Although the banks are critical of the business use of private accounts, they tolerate them within a manageable framework. Self-employed sole traders and freelancers will therefore seldom encounter problems with their bank if they use private accounts for business purposes.

What are the Differences between a Business Bank Account and a Private Account?

Business accounts are more expensive than private accounts. Many banks offer a free current account for private use. With business accounts, on the other hand, there are not only the monthly fees for account management. Individual bookings are often also charged with fees. Furthermore, business accounts cannot be provided with an overdraft facility. Self-employed persons who need an overdraft facility must apply for a current account overdraft facility. However, the bank will only approve a current account overdraft if the company’s figures are positive. Past annual financial statements and business management evaluations must be submitted with the application.

On the other hand, some banks offer their business customers interest on the credit balance of the business account.

Especially for self-employed sole traders and freelancers, many banks offer free business current accounts. Some banks also allow their customers who are self-employed sole traders or small businesses to open a second private account or a sub-account.

Before opening a business account, it is therefore worthwhile comparing the banks thoroughly with regard to their conditions.

What are the Advantages of using a Business Account for Self-Employed Persons?

Just like the costs for the individual postings, the expenses for account management can be counted as business expenses and thus be tax deductible. The decisive advantage, however, lies in the bookkeeping.

Business Account for Self-Employed Persons – Well Organized Accounting

Keeping a business account makes bookkeeping much easier for self-employed people. This is because the business account provides a clear separation between private and commercial payment transactions.

For accounting, the use of a business account brings further advantages:

- Postings can be clearly assigned if only business account transactions are carried out via the business account. This eliminates incorrect allocations and ambiguities in advance.

- Only business account movements are listed on the business account and its documents. This facilitates an overview of payment transactions. It also means that it is quicker and easier to assess the financial situation of the enterprise.

- Sorting the documents is much easier if only business payment transactions are carried out via the account in question

- The burden of proof to the tax office is much less complicated. Because only the account vouchers of a business account are tax-relevant vouchers. In this way, the tax office does not receive any private and fiscally irrelevant documents.

- Banks often offer their customers sub-accounts for business accounts. These allow further sorting of business payment flows and can organize business transactions even better and more transparently.

The risk of inadvertently drawing on reserves for private expenditure that would have to be retained for the next input tax levy is significantly lower.

Also read this article about some good reasons for a separate business account.

Conclusion – do you need a Business Bank Account?

The decision for or against a business account is completely individual. If you use a business account, the banks are happy about the fees, but the tax office does not care.

There is no law or regulation that would oblige the self-employed to set up a business account for their business finances. The tax office is only interested in making sure that the business bookings are traceable and correct. It is not interested in which type of account is used for this purpose.

Banks see things quite differently: in most fee schedules, business accounts are charged much higher fees than private accounts. So you have a vested interest in self-employed people setting up an extra account. However, as long as the bank’s general terms and conditions do not explicitly exclude business use of the account, self-employed people do not need to be advised by the bank to set up the more expensive business account.

Here is a list of business accounts for self-employed persons in the US.

More Tips for Business Owners:

How can VoIP improve your Business

Grow your Business with good Software